American Airlines, the largest U.S. carrier in South America, has been without a local partner in much of the region since Latam Airlines shocked the industry with its pivot to Delta Air Lines two years ago. Now, American has a plan to close much of that gap with a new partnership with Chile’s JetSmart Airlines in what appears to be a tradeoff in favor of growth opportunities despite vastly business models.

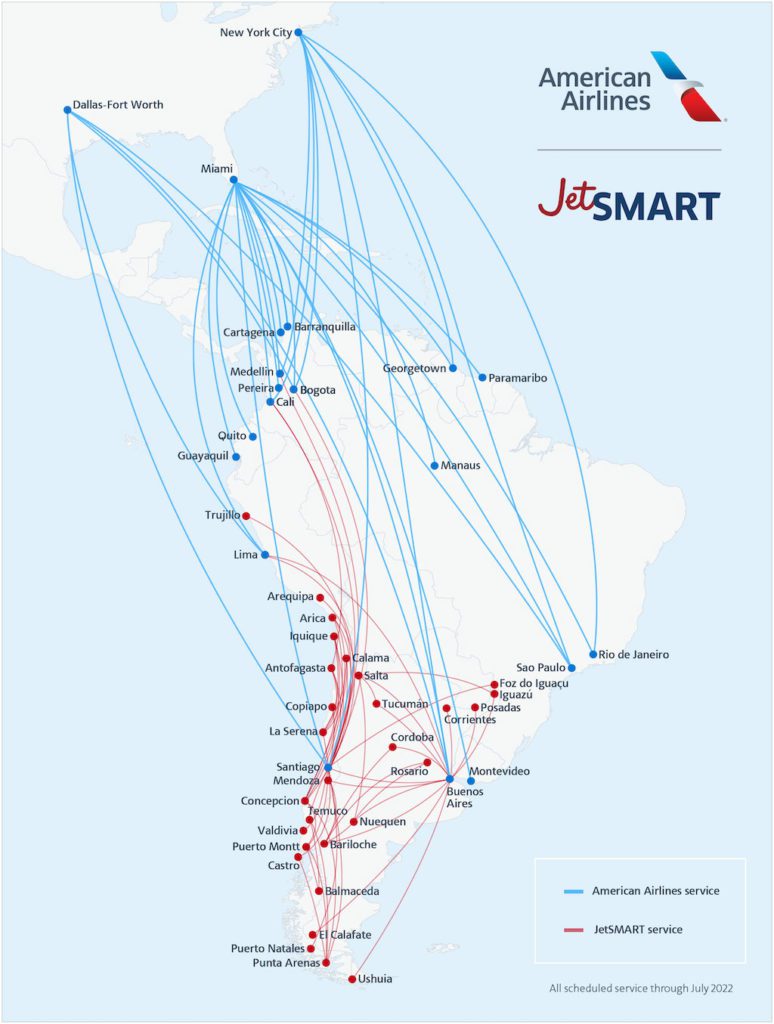

The pact, which is only a letter of intent at this point, is three pronged. One, American will buy a minority stake in JetSmart. Two, the U.S. carrier will extend frequent flyer earning and redemption benefits to its new partner. And three, the airlines will implement a broad codeshare on American flights to and from South America, and JetSmart flights within the continent. All aspect of the partnership are subject to approvals.

The tie up is not exactly a match made in heaven. American is a full-service, network airline whose aim is to connect travelers to points far and wide around the globe. Four-year-old JetSmart is an ultra low-cost carrier with bases in Argentina and Chile, and a fleet of just 18 Airbus A320 family jets (plus another 68 aircraft are on order).

For comparison, JetSmart was just 5 percent the size of just Latam’s intra-South American operations in terms of seats in 2019, according to Cirium schedule data.

What, then, is American thinking? Network.

Buried in the U.S. carrier’s statement, it revealed a commitment, along with JetSmart majority owner Indigo Partners, to provide additional capital for “potential future opportunities in the region.” Additional funding could accelerate the Chilean carriers ambitions to expand in and beyond its two existing markets into other countries in South America, for example Colombia and Peru. Adding domestic operations there would help American by closing the gap left by the end of its Latam partnership.

In addition, said funds would help JetSmart fulfill its ambitions. Speaking at a Routes conference in May, CEO Estuardo Ortiz said the airline saw significant growth opportunities, primarily from stimulating traffic with lower fares, both in Argentina and Chile as well as elsewhere in South America. He named Peru as one country ripe for growth in the recovery, including citing the fact that roughly a quarter of domestic capacity in 2019 has left the market for good.

“This proposed partnership would accelerate JetSmart’s path to becoming the leading South American low-cost carrier,” said Ortiz in a statement Thursday. This sentiment was echoed by American Chief Revenue Officer Vasu Raja who added that the pact enabled the carriers to “grow aggressively.”

For Brazil, South America’s largest market, American already has a partnership with Gol. That pact was signed in February 2020, six months after Latam’s departure to Delta. Commenting Thursday on the new American-JetSmart deal, Gol CEO Paulo Kakinoff said the airline welcomes the new tie up and added that it could “strengthen our position” in the region suggesting a potential future Gol-JetSmart tie up. The Brazilian carrier is in the process of acquiring Map Transportes Aéreos to expand its share in its home market.

Bob Mann, an adviser at R.W. Mann & Company and former airline executive, said the JetSmart partnership fits with American’s focus on austerity across its domestic fleet. This includes recent cabin retrofits that added seats to its Airbus A321s and Boeing 737s, and choice to push bring-your-own-device inflight entertainment.

“Perhaps this is [Doug] Parker’s revived nod to the ‘fundamental change’ — a relentless push for lower costs via austerity and unbundling — that Bill Franke always talked about as being necessary to commercial airline practice,” said Mann. Parker is CEO of American, and Franke is the founder and managing partner of Indigo Partners.

Still, one has to wonder what high-value corporate flyers will think when they face the option of transferring from an American business class seat to a cramped JetSmart economy seat, compared with the same option on Delta with Latam as its local partner. As they say, necessity creates strange opportunities.