EasyJet Responds to Spurned Wizz Air Offer With a 3-Pronged Growth Plan

There’s nothing like an unsolicited takeover bid to get airline management moving. Fresh off one such rejected offer, reportedly from Wizz Air, EasyJet has unveiled plans to capture more share from legacy competitors and become a “local airline” brand in many other destinations across Europe.

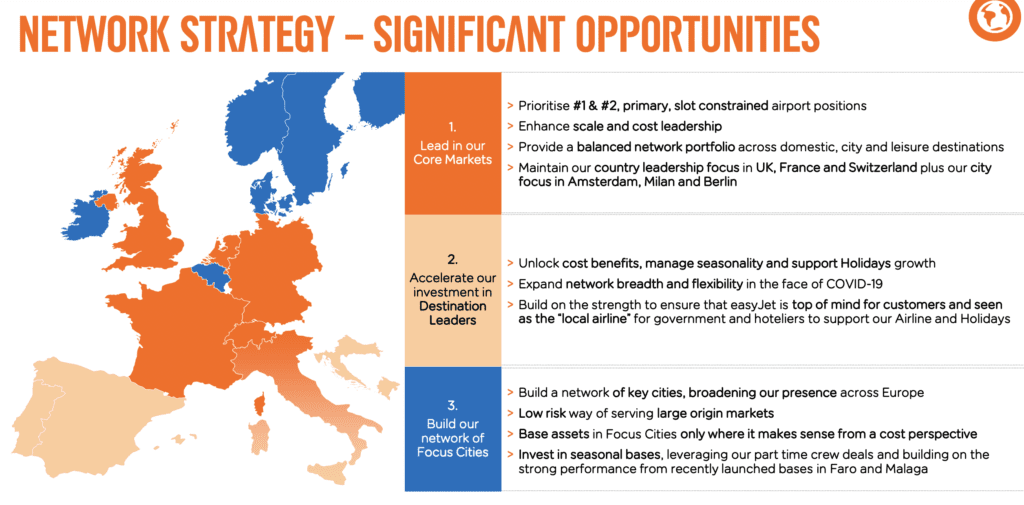

London-based EasyJet’s growth plan has three legs. One, leverage and expand its leading position at slot-constrained airports in Western Europe — for example at Amsterdam Schiphol, London Gatwick and Paris Charles de Gaulle — versus legacy competitors. Two, build depth in destinations in places like southern Italy, Portugal and Spain in order to become a “local airline” in the eyes of local officials and tourism authorities. And three, add new focus cities in markets where it has a smaller presence, including Belgium, Ireland and Norway.

This growth, funded in part with proceeds from the roughly £1.2 billion ($1.7 billion) rights issue that launched on Thursday, will “protect and strengthen EasyJet’s long‐term positioning in the European aviation sector,” the airline said.

And protecting its competitive position is very much top of mind for EasyJet. European budget leaders Ryanair and Wizz have both outlined ambitious growth goals fueled by the hundreds of aircraft they have on order. They too see an opportunity in the pandemic retrenchment of the continent’s major airline groups — Air France-KLM, IAG and Lufthansa Group. In July, Michael O’Leary, CEO of Ryanair, went as far as to say his carrier is the “only airline” capable of fully taking advantage of recovery growth opportunities.

EasyJet’s main strength is its competitive positions at many of key Western European airports. In 2019, the airline was number one at Gatwick and Milan Malpensa in terms of departures, and number two at Charles de Gaulle and Schiphol, according to Cirium schedule data. Slot limits at these airports make Air France, Alitalia — soon to be Italia Trasporto Aereo (ITA) — British Airways and KLM greater competitors to EasyJet than budget carriers. But outside these and other key markets, EasyJet’s ability to grow is limited without more planes.

According to a July presentation, EasyJet forecasts a fleet of 331 aircraft by September 2024, which is down from 342 aircraft at the same time in 2020 but up from a pandemic low of 307 planes. Gauge growth — 186-seat Airbus A320neos replacing 156-seat A319s and 180-seat A320s — will allow the airline to add seats and capture more share in key markets through 2024. But adding new routes and focus cities becomes a matter of robbing Peter to pay Paul without additional aircraft.

Ryanair and Wizz do not face that problem. Both have robust orderbooks that will allow the former to grow to roughly 600 Boeing 737s and the latter to 246 A320 family jets by 2026. Ryanair had 451 aircraft and Wizz 141 at the end of June. EasyJet has 101 Airbus A320neos and A321neos on order, plus options and purchase rights for another 78 A320neo family jets.

Adding planes and growing an airline requires capital. EasyJet had £2.9 billion in unrestricted cash at the end of June and, if proceeds from the rights issue come in as forecast, that number could jump by more than 41 percent to £4.1 billion. The airline also disclosed a new $400 million senior secured revolving credit facility.