Viva Aerobus, a low-cost airline in Mexico, has announced six new routes to the U.S. from Monterrey, its busiest airport. The move follows the long-anticipated U.S. government decision to upgrade Mexico’s aviation safety designation to Category 1, reopening the U.S. market to expansion by Mexican airlines.

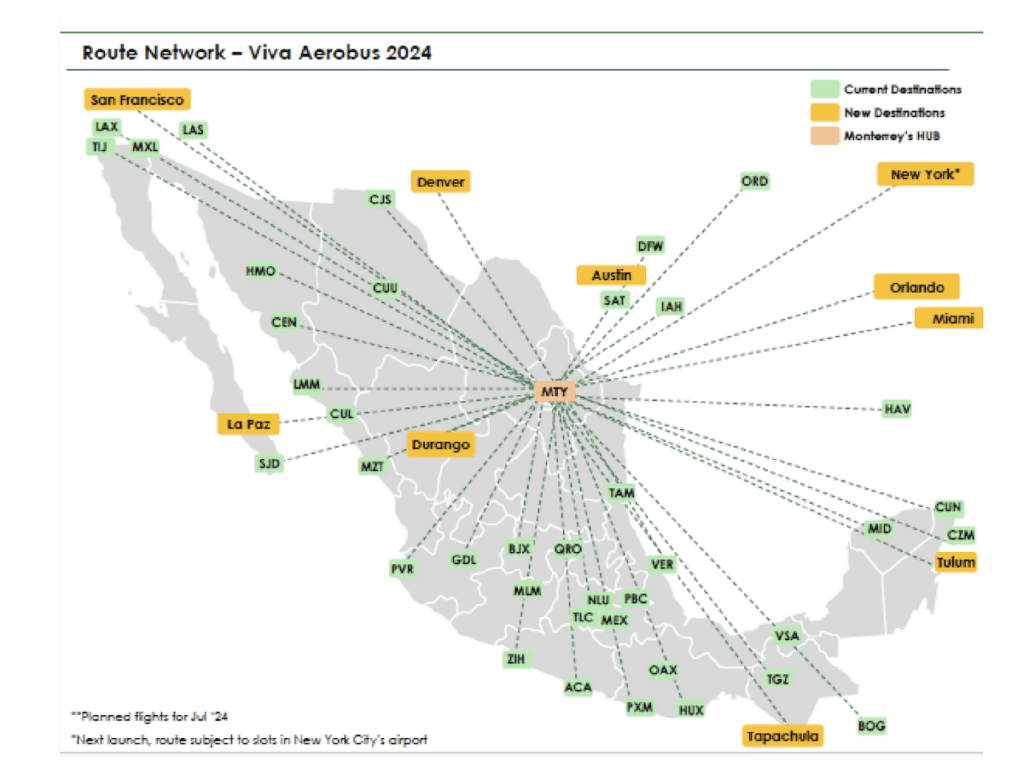

The ultra low-cost carrier will fly to Austin, Denver, Miami, New York JFK, Oakland, and Orlando from Monterrey with launch dates ranging from January (Denver) to July (Miami and Oakland). All but New York, which Viva Aerobus already serves from Mexico City, will be new to its network.

The Federal Aviation Administration upgraded Mexico’s safety rating earlier in September after more than two years at Category 2. At that status, Mexico’s airlines were prohibited from adding new cross-border routes.

New U.S. routes from Aeromexico, the country’s flag carrier, and Volaris, Mexico’s largest airline, are expected soon.

As part of its Monterrey expansion, Viva Aerobus will also add three new domestic routes to Durango, La Paz, and Tapachula. Monterrey and the surrounding area are seeing an influx of new industrial investment as multinational companies re-shore operations to North America, often from Asia. As a result, airlines see potential to grow outbound tourism, in addition to the visiting family and friends, or VFR, traffic that typically accounts for a large portion of Mexico-U.S. air traffic volumes. For beach markets like Cancun, inbound tourism is the largest source of demand. Business demand is expected to increase too. Mexico became the largest trading partner of the U.S. earlier this year, surpassing China.

Viva Aerobus’ cross-border ambitions include formation of a joint venture with Las Vegas-based Allegiant Air. That too was put on pause while Mexico’s safety rating was downgraded. But a separate dispute may prove the bigger obstacle. The U.S. is unhappy with a recent Mexican directive to relocate certain flights to a new secondary airport for Mexico City, Felipe Angeles, making it less likely the U.S. would quickly approve the venture. Mexico City’s main airport is Viva Aerobus’ second busiest after Monterrey by scheduled seat capacity, according to Cirium Diio.

The discounter is also expanding at Felipe Angeles as the administration of Mexico’s President Andrés Manuel López Obrador pressures airlines to move more flights there from Mexico City International Airport. Viva Aerobus will add 17 new domestic routes from Felipe Angeles and designate the airport a “strategic hub” from December. The new routes, which include Guadalajara, Huatulco, and Merida, launch between December and July 2024. Beginning in January, the López Obrador will cut the number of hourly flights Mexican airlines can operate at Mexico City’s main airport.

During the April-to-June quarter, Viva Aerobus earned an impressive 14% operating margin, reflecting strong demand trends and constricted supply. Mexico is essentially a three-airline market since the demise of Interjet during the pandemic. A new military-run airline using the revived Mexicana brand aims to compete with the three incumbents, Aeromexico, Viva Aerobus, and Volaris. All three are roughly similar in size based on seat capacity, with fourth-quarter schedules showing Volaris with 8.5 million seats, Viva Aerobus with 7.6 million, and Aeromexico with 6.6 million.

Both Volaris and Viva Aerobus operate Airbus A320neo-family jets with Pratt & Whitney’s troubled geared turbofan engines. But the impact has seemingly been greater for Volaris than Viva Aerobus to date. The latter’s seat capacity will be down 5% year-over-year in the fourth quarter, owing in part to the engine issues. Viva Aerobus, by contrast, expects capacity to grow 15%.

As for the Mexico-U.S. market specifically, American Airlines and United Airlines are the leading players in terms of capacity — both have Texas hubs which serve as geographically well-positioned gateways for Mexico. Among Mexico’s three main airlines, Volaris has the most cross-border capacity. It too plans to add lots of new flights in the wake of the Category 1 decision.